After months of negotiation, Congress reauthorized the U.S. International Development Finance Corporation (DFC) in mid-December as part of the 2026 National Defense Authorization Act, expanding the institution's funding ceiling more than threefold—from $60 billion to $205 billion.

The reauthorization bill also enhances the DFC's ability to make riskier equity investments and clarifies its authority to invest in companies and organizations in high-income countries. If utilized successfully, these changes could be particularly significant for the DFC's work in global health and health security. These changes also arrive as overall resources for global health are scarce, and as the United States and other countries slash their foreign assistance budgets.

The DFC's COVID-19 response demonstrated its global health potential: a $1 billion vaccine liquidity facility and multiple medical countermeasure (MCM) manufacturing investments, including through Quad Summit partners Australia, India, and Japan. If effectively executed, the DFC's expanded resources and institutional reforms can catalyze robust MCM infrastructure, strengthen health-care supply chain resilience, and address critical vulnerabilities. The State Department's America First Global Health Strategy affirms that such investments directly benefit U.S. citizens by strengthening preparedness for biological threats but doesn't address open questions about MCM supply and manufacturing during serious health events.

The key question is how the DFC can leverage its institutional legacy and sustained U.S. national interest in global health security to make high-impact investments.

Key Financing Changes Enable Greater Health Impact

The reauthorization bill more than tripled the DFC's maximum contingent liability, meaning the total amount that the corporation is authorized by Congress to lend or invest at a given point in time. This threefold increase mirrors the Trump administration's fiscal year 2026 budget request for a 280% increase in annual funding for the DFC. It is essential that the DFC's health and health-security portfolio receives a fair allocation of any new appropriations provided to the corporation this year.

Health investments remain equally important to advancing U.S. interests at home and abroad

While areas recently prioritized for DFC investment like energy, critical minerals, and telecommunications infrastructure undoubtedly require significant quantities of public capital to advance global development outcomes and U.S. interests, health investments remain equally important to advancing U.S. interests at home and abroad. As budget constraints increase global health-security risks, such as emerging infectious diseases, bio-misuse, and antimicrobial resistance, the global health architecture is shifting—notably as the United States moves away from development investments in health and withdraws from multilateral health institutions.

But if the America First Global Health Strategy's emphasis on country self-reliance wants to work, the U.S. government needs to meet fixed capital needs through concessional financing mechanisms like those available through the DFC. The DFC might be the U.S. government's only option to seriously address this specific challenge, as the Trump administration continues to pull back from multilateral institutions and struggles to expand its permanent international investment authorities at other agencies.

Formalizing the DFC's ability to invest in the United States and other selected high-income countries is a welcome change. For health security, this reflects the reality that companies located in high-income countries have the advanced manufacturing capabilities and cutting-edge technologies that can support low- and middle-income countries (LMICs). This shift would enable the DFC to invest in MCM production for health and supply chains, similar to its recent participation in the Orion-led investment consortium on critical mineral supply chains.

Increased flexibility, however, could lead the DFC to prioritize deals in other high-income countries due to reduced transaction costs and greater familiarity for investment and diligence teams. These changes could also encourage politically motivated investments lacking commercial grounding, clear policy impact, or long-term financial viability, like attempts under the first Trump administration to invest in domestic pharmaceutical projects using Defense Production Act authorities and more recent failed attempts to use DFC resources to invest in domestic mines. Directing DFC leadership and staff to increase their investment-risk appetite is also a well-received move, particularly for health-security investments, which can be riskier than building hospitals, data centers, or energy plants. This direction helps free the DFC to work in LMICs where risk is higher but need (and potential policy or even financial return) is greater.

Expanding the DFC's equity investment authorities further improves alignment with the agency's toolkit and the pursuit of health-sector objectives, especially in areas impacting long-term health outcomes that often have extended return cycles for impact and capital. The reauthorization bill's passage through a bipartisan and bicameral congressional process also demonstrates that U.S. global health investments can still be strengthened and reformed through transparent legislative action, not solely executive action.

How the DFC Can Complement Global Health Security and Diplomacy

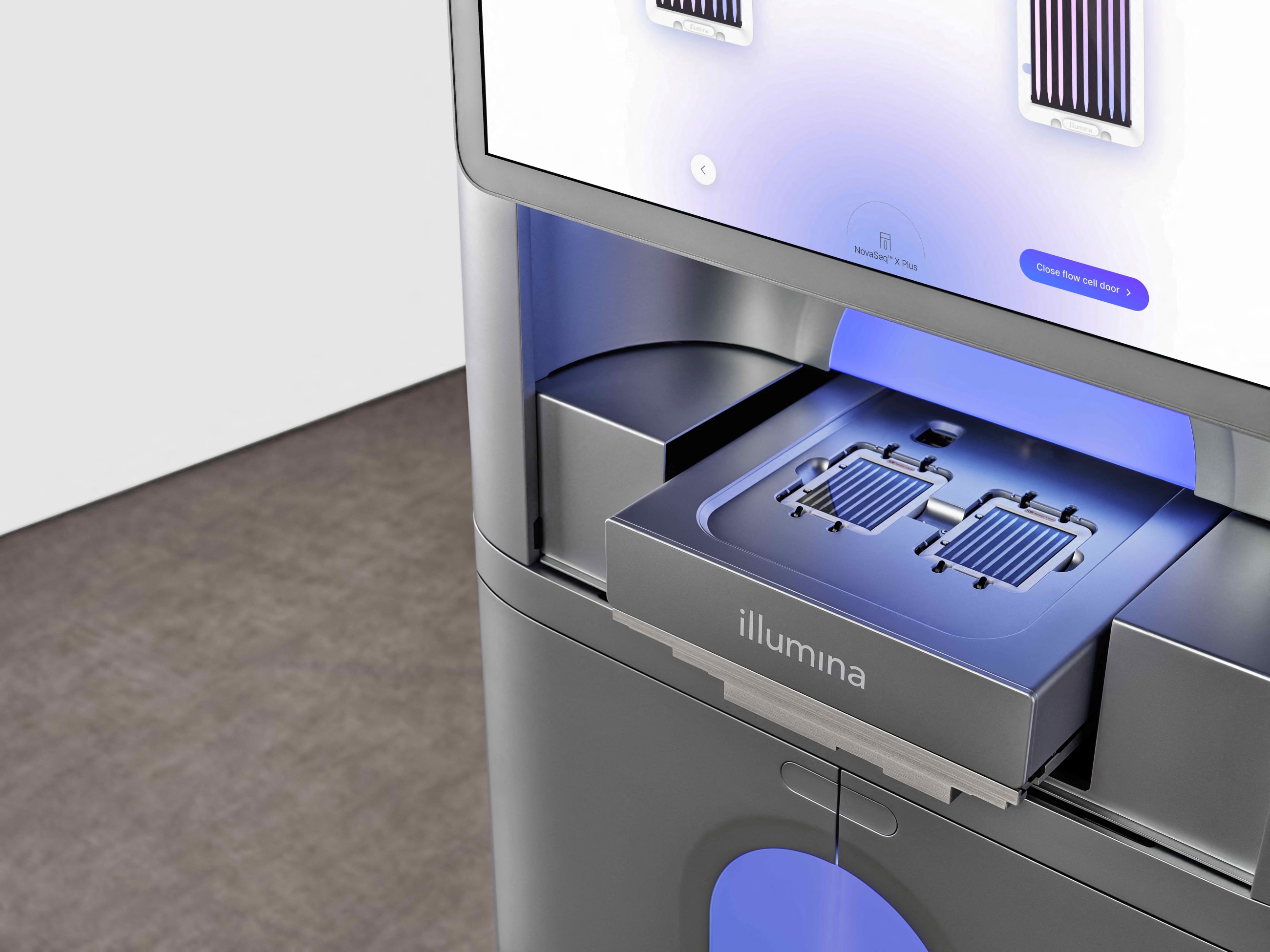

The first arena is financing infrastructure for threat detection and MCM manufacturing. U.S. allies and partners include countries with weak technological infrastructure but crucial early information on emerging biological threats. Pathogen genomic sequencing enhances national security by enabling earlier detection of emerging infectious diseases, informing rapid development of diagnostics and vaccines, and improving surveillance. However, sequencing infrastructure requires capital-intensive machines. In addition, the global sequencing market is driven by strategic competition, which has led to the clear market leader, U.S. company Illumina, being banned in China for the greater part of 2025. This makes it important for the United States to view capital equipment for sequencing as addressing both biosecurity and strategic interests.

While genetic sequencing machines could generate revenue through human genome studies during routine times, LMIC commercial capital markets won't sufficiently invest in the required capital expenditures. DFC loans, equity, or loan guarantees can enable adequate investment in infrastructure, lower the cost of purchasing Illumina machines, and derisk investments in infrastructure for the installation, maintenance, repair, and continued use of such machines. This approach aligns with broader U.S. national security goals—and is particularly urgent as Chinese company BGI rapidly gains technological and installed-base advantage over U.S. sequencing companies. Stronger capacity in detection and sequencing can be networked with existing LMIC manufacturers, including those receiving DFC support to expand their capacity, beginning to build an ecosystem that is less dependent on donations from the United States or other countries during emergencies.

The second way that the DFC can complement security and diplomacy is through financing the commercialization of U.S.-developed medicines for global diseases, some of which also have military applications.

Malaria takes a huge toll globally, responsible for 282 million cases and 610,000 deaths in 2024. Three-quarters of those fatalities affected children. In addition, the mosquito-borne disease remains a persistent health threat to U.S. service members stationed in or near endemic regions, whether due to duty assignments, contingency operations, or personal travel. Americans also face the risk of malaria through international travel, and more recently through 2023's local transmission of malaria within the United States. The U.S. military has developed effective countermeasures, such as chemoprophylactic drugs, permethrin-treated uniforms and bed nets, and DEET-based insect repellents, but these tools aren't always practical or consistently used in field conditions. The Department of Defense (DOD) and Walter Reed Army Institute of Research have developed several globally used frontline antimalarial drugs, yet breakthroughs are still needed to improve operational feasibility and adherence.

In 2024, the Medicines for Malaria Venture (MMV) received approval for a single-dose cure for vivax malaria, which is endemic in Latin America and Southeast Asia. MMV is currently developing a single-dose long-acting treatment for falciparum malaria. Both treatments could significantly reduce the pill load for service members and enhance treatment compliance for American service members and African patients.

However, even if approved, a lack of available capital to scale commercialization and manufacturing infrastructure poses a major barrier. Since 95% of malaria cases and deaths occur in Africa, it is logical to invest in a sustainable manufacturing base for malaria treatments and vaccines in the region. Traditional venture-capital and private-equity investors generally won't fund expansion of products serving strategic or national security priorities and weak global markets without near-term commercial profitability.

Another example is emerging snakebite technologies. U.S. service members in austere, forward environments face serious snakebite risk, yet traditional antivenoms are species-specific, logistically complex, and unavailable for some species. DOD has funded development of broad-spectrum antivenoms effective across species, a dual-use opportunity for both defense and civilian use. Scaling manufacturing abroad would reduce DOD procurement costs while addressing a major global health threat causing up to 138,000 deaths annually, with the highest burden in countries such as India and Nigeria.

Private capital is unlikely to commercialize and deploy internationally these DOD-funded innovations because of regulatory complexity and weak market incentives in LMICs, creating a clear role for targeted high-impact DFC interventions. The DFC could also support complementary solutions, such as covering fixed costs of drone-based delivery of matched antivenoms from district hospitals to improve timely access in remote areas—similar to the Zipline investment made recently by the State Department. The strategy could be useful particularly if the Bureau of State Global Health, Security, and Diplomacy (GHSD) is already funding these deliveries for medicines and routine health products.

Execution Risks Demand Oversight and Capacity-Building

While increased congressional oversight is positive, the DFC's health initiatives risk becoming overly focused on administration-driven, transactional deals rather than long-term investments that advance global health and health-security objectives aligned with the dual foreign policy and development mission of the DFC, as reaffirmed in the recent reauthorization bill.

Realizing sustained impact in any sector, but particularly global health and health security, will also require a substantial increase in institutional capacity at the DFC. These types of initiatives call for expanded, specialized staffing to grow the agency's health portfolio effectively. If the DFC intends to scale its programs in this area, it will need health and science talent from inside and outside the government to join its ranks. The corporation's newly expanded hiring authorities are important tools for building this type of in-house capability and capacity over time.

This focus on institutional capacity-building is especially pertinent given the smaller global footprint left by the elimination of U.S. Agency for International Development and scaling down of other U.S. development activities around the world. It remains unclear whether DFC will undertake the hard task of recruiting the talent critical for MCM and health security—or whether new hiring and operational efforts will skew toward hiring and training generalist investment professionals with a focus on other sectors. Strong congressional and public oversight is now more essential than ever to protect and grow the DFC's health and health-security programs.

This is a moment of opportunity. If used correctly, the DFC's new authorities and expanded mandate could facilitate an expansion in U.S. engagement on global health-security topics—substantially advancing U.S. interest around the world and improving health outcomes for those most in need—but success will hinge on the prioritization of health in the DFC's portfolio, sustained executive-level focus on these topics, and the perennial challenge of disciplined execution.